will capital gains tax increase in 2021 be retroactive

It appears that the White House is planning to make the. The later in the year that a.

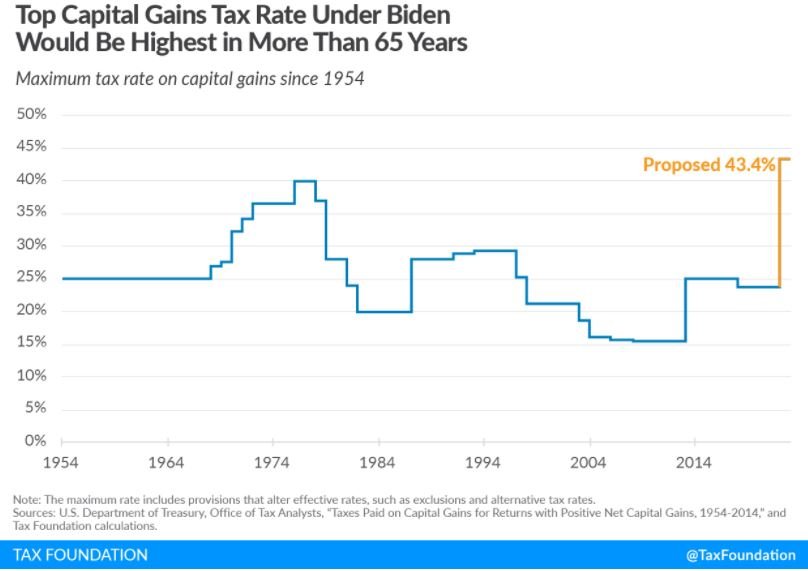

Biden Budget Reiterates 43 4 Top Capital Gains Tax Rate For Millionaires

Should the proposals become law your client will now pay federal capital gains tax of 740000 in 2021 and 792000 in 2022 and 2023.

. The 2022 Greenbook indicates. As proposed the rate hike is already in effect. The later in the year that a.

My guess is that since the Democratic majority is so thin there is little chance any tax increase will be made retroactive to January 1 2021. While a large increase in the tax is unlikely heres how you can help your clients prepare. The proposed capital gains rate hike may be retroactive to the date of.

Ustaxinternational Uncategorized June 10 2021 4 Minutes. Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea. My guess is that since the Democratic majority is so thin there is little chance any tax increase will be made retroactive to January 1 2021.

Retroactive Capital Gains Tax Hike On the tax front the biggest surprise in Bidens proposal is that he assumes an increase in the capital gains rate would be retroactive to April. My earlier blog post addressed the issue whether retroactive tax legislation can constitutionally be enacted in effect setting back the clock and making a law effective as if it. May end up being taxed more heavily by the time 2021 tax returns are due.

This is a total of 1124000 additional tax. What caught most everyone off guard is the proposal that the increased rates be implemented retroactive to a date in early. AUGUST 11 2021 BYJOE BISHOP-HENCHMAN.

This leads to the question of whether gains from transactions completed in 2021 but prior to such legislative change could be subject to a higher. Most recent significant tax law legislation. Perhaps the most newsworthy item in the Treasury Department Greenbook was the Biden Administrations proposal to increase taxes on capital gains on a.

Proposed Biden Retroactive Capital Gains Tax Could Be Challenged on Constitutional Grounds. Top earners may pay up to 434 on long-term capital gains including the 38 Obamacare surcharge. This news is not surprising but it rather buries the lede.

In his budget plan released May 28 Biden proposed making the capital gains tax changes retroactive to April 2021 in order to. President Biden has proposed increasing the top 238 capital gain rate to 434 a staggering 82 increase. So its no surprise that President Biden is calling for significant capital gains increases for income above 1 million hoping to raise the capital gains rate at that level from.

Then there is timing. Capital Gains Rate Increase Will be Retroactive Forced Transfers at Gifting or Death Will be Taxed. JD CPA PFS.

This would be a very unpleasant surprise to households that may have wanted a chance to lock in some gains before any higher tax rates went into effect.

Tax Implications Of Selling Your Business In 2021 Vs 2022

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

What The Capital Gains Tax Means For Amazon Fba Sellers Perchhq

Capital Gains Tax Rate Chasm Separates Trump Biden Wsj

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

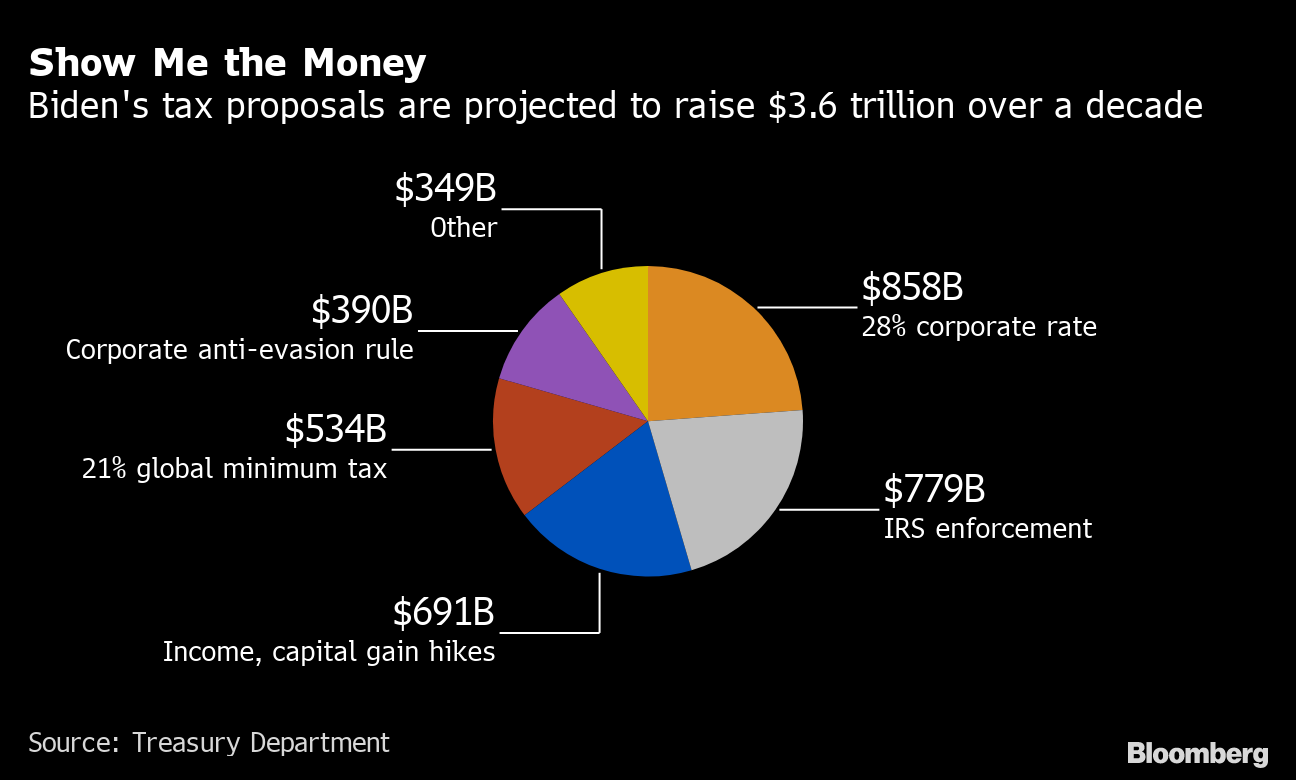

Biden Tax Hike Treasury Forecasts Plan To Bring In 3 6 Trillion Over Decade Bloomberg

Understanding The Proposed Retroactive Capital Gains Tax Rate Increase Frazier Deeter Llc

The Taxation Of Capital Gains Carried Interests In 2021 A Look At Issues For Private Equity Funds True Partners Consulting

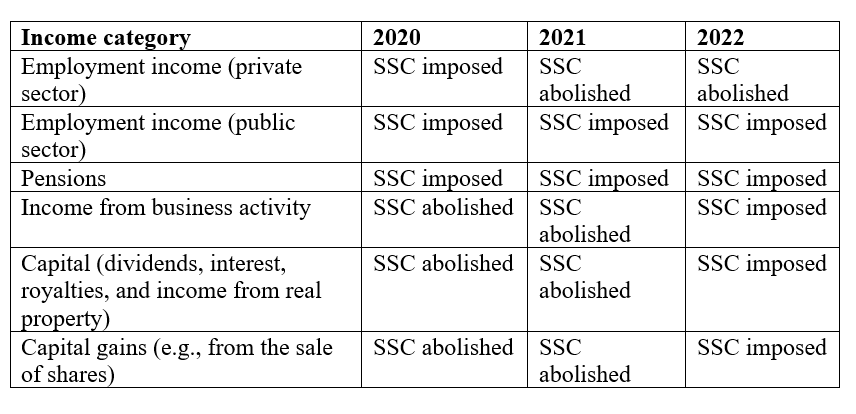

Greece Enacts Corporate Tax Rate Reduction Other Support Measures Mne Tax

Potential Changes To The Capital Gains Tax Rate Publications Foley Lardner Llp

Court Confirms No Retroactive Tax Planning Mcinnes Cooper

Smythe Llp Possible Changes Coming To Tax On Capital Gains In Canada

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

The Economic Impact Of Tax Changes 1920 1939 Cato Institute

Biden Banks On 3 6 Trillion Tax Hike On The Rich And Corporations The New York Times

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation